Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

4 posters

Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Are we about to see Fantastic Four and X-Men join the Marvel Movie universe? One of the biggest Hollywood shake-ups in history is drawing near.

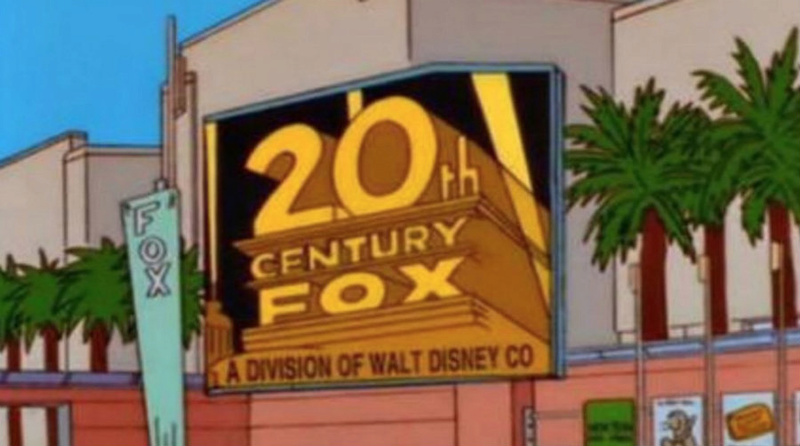

A few weeks ago, it was revealed that 21st Century Fox is looking to sell off most of its assets, including their movie studio, 20th Century Fox, and TV assets. Disney has been the frontrunner from the very beginning and now, a new report claims that the Mouse House is very close to closing the deal, which could be announced as soon as next week. Here's what the new report had to say about it."Disney and 21 Century Fox are closing in on a deal, and it could come as soon as next week, according to sources familiar with the matter."

Other companies are in contention to purchase Fox's assets, or at least were in contention. Fox was also talking with Comcast and Sony was said to be in the running for the purchase, but the Disney talks "have progressed more significantly," according to this new report. The deal would include Nat Geo, Star, the company's regional sports networks, movie studios and their shares of Sky and Hulu. Fox would keep its news and business news divisions, their broadcast network and Fox Sports. But the rest would go to Disney.

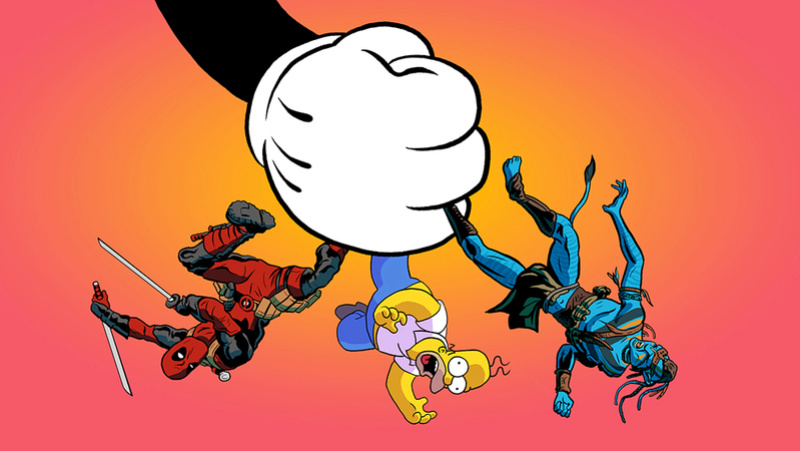

This deal would be massive, as one of the major studios in Hollywood would essentially dissolve, or at least become an arm of another major studio. Disney is the biggest of the big, as they already own their massive library of legacy titles, Marvel and Lucasfilm. If they get Fox's assets, they'll be truly untouchable. Marvel fans are particularly interested in the potential purchase, as it means that Disney would finally be in control of the X-Men and the Fantastic Four again.

While Marvel fans are excited about the possibility of seeing Wolverine and Cyclops team up with The Avengers at some point, there are many other implications to a deal this big. For one, Disney is launching their own streaming service next year and this would provide them with a massive library of content for the service. But there's also all of the other franchises under Fox's control, like Planet of the Apes and Alien, just to name a couple. What fate will such franchises suffer under the Disney umbrella? This may well be a situation where consumers have to take the good with the bad.

It's possible Disney could keep 20th Century Fox as its own studio under the Disney umbrella and allow them to continue making movies, but that's speculative at this point. The other huge part of this new report from CNBC is that it estimates the Fox assets in the Disney deal at more than $60 billion. Yes, billion. With a big B. The other thing worth noting is that shares of Twenty-First Century Fox went up Tuesday, while shares of Disney fell 2.7 percent Tuesday. This deal will surely have a huge effect on stocks, if it is indeed announced next week.

Last edited by WyldeMan on 6/13/2018, 2:28 pm; edited 4 times in total

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Just what those pimps at Disney need, another bottom dollar bitch to control and destroy.

Disney had better keep their damned dirty hands of those Apes films.

Disney had better keep their damned dirty hands of those Apes films.

_________________

Wylde's Favorite Films of 2024:

Dune Part II

Wylde's Favorite Series of 2024:

Fallout (Prime), The Gentleman (Netflix), Shogun (Hulu/Disney+)

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

YOU CAN DO IT DISNEY! YOU CAN DO IT!!!!!!!!!!!

UltimateMarvel- Posts : 10277

Join date : 2014-12-09

Location : East Coast

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

UltimateMarvel wrote:YOU CAN DO IT DISNEY! YOU CAN DO IT!!!!!!!!!!!

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Sony and Disney play nice now. I’d rather Sony get it, Disney is too big as is.

Tyger- Posts : 3482

Join date : 2014-12-09

Location : Utah

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Tyger wrote:Sony and Disney play nice now. I’d rather Sony get it, Disney is too big as is.

I'd prefer Sony as well but there's no stoppin Iceberg SlimDisney.

Here's a really good write-up from Deadline.com on What a Fox/Disney Merger would look-like

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

The Disney and Fox deal is expected to be officially finalized by Thursday. The whole process has not been a walk in the park for both camps. On top of the legalities that need to be taken care of, Disney has also faced competition, with both Sony and Comcast joining the bidding war to acquire 21 Century Fox’s TV and movie division (which is worth $60 billion). In the end, the House of Mouse emerged as the clear winner, after Comcast backed out of the race on Monday.

Admittedly, not everyone is happy with the game-changing move. With its own set of risks, several industry people – including Logan director James Mangold and Deadpool creator Rob Liefeld – have expressed their concerns regarding the purchase and how it could affect the movie-making business in the future in a negative way. However, with the deal only waiting to be announced now, it’s safe to assume that there’s nothing more that can be said to prevent what’s coming.

According to CNBC (citing sources that have personal knowledge of the matter), Fox and Disney are currently on a “glide path” towards the merger and if everything goes according to plan, it will be formalized this Thursday with a presser. That would be on-schedule with reports last week that the sale could fully materialize sometime this week. The package will reportedly include Fox’s A&E and Star TV networks, its regional sports operation, as well as stakes in both Sky and Hulu, and IPs like The Simpsons and Avatar; not to mention the unaltered version of the original Star Wars trilogy. It’s particularly huge for Marvel fans as it means that Marvel Studios could regain control over their mutant IPs.

Meanwhile, current Fox shareholders will reportedly get one share of the company that remains after the buyout, along with shares of Disney in a fixed exchange ratio.

Disney’s plans – once they officially get their hands on the massive Fox portfolio – remains to be seen, but word has it that it has something to do with stacking up their IPs in preparation for launching the Disney streaming service come 2019. This huge acquisition has evoked differing views and continues to be a popular topic of conversation among industry people, as well as casual fans. Some are in favor of the deal, especially those who consider the countless narrative opportunity for Marvel Studios to finally get their hands on the X-Men and Fantastic Four. Others, meanwhile, tend to look at the bigger picture and how this buyout could impact the whole industry. One less major film Hollywood studio could lead to fewer jobs and more streamlined content, resulting to a lack of variety when it comes to both films and TV shows.

That said, it’s hard to fathom that Disney will spend billions of money and not capitalize on the assets that Fox has already built in its storied history, including their successful R-rated projects (similar to what Disney did with Miramax in the 1990s). Looking back at the House of Mouse’s buyouts over the years (with Bob Iger at the helm) of Marvel Studios, Pixar, and Lucasfilm, all of the companies have flourished under the conglomerate, making it a win-win situation for all parties involved, and most importantly for fans. It’s possible that Fox will function the same way the aforementioned subsidiaries have – retaining its name, control of most of its IPs, and its iconic studio theme and banner, just with the backing from Disney.

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

The gods have chosen. This is good!

UltimateMarvel- Posts : 10277

Join date : 2014-12-09

Location : East Coast

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

UltimateMarvel wrote:The gods have chosen. This is good!

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

I couldn't care less about this.

The only thing of interest is the original Star Wars trilogy. I would be nice to watch them in HD without George Lucas' added fuckery.

The only thing of interest is the original Star Wars trilogy. I would be nice to watch them in HD without George Lucas' added fuckery.

Rusty- Posts : 3894

Join date : 2014-12-09

Location : Australia

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Disney-Fox Deal: 10 Burning Questions as Takeover Deal Looms

Disney and Fox are racing towards the finish line.

The two media companies are expected to announce a $60 billion-plus pact this week that will see Disney snap up much of Fox’s television and film holdings. If completed, the deal will dramatically reshape the entertainment landscape, bringing together for the first time two of Hollywood’s “Big Six” studios under common ownership, all to give Disney the bigger arsenal of programming it needs to do battle with Netflix and other new entrants in the content business.

Details of the plan and deal points are being closely guarded. There are also many uncertainties about who will run the combined companies, how the government will react to the prospect of consolidation among Hollywood studios, and what it all means for the creative community. Here’s a look at key questions that need to be addressed.

1) Will the Murdochs be involved in Disney?

Yes, they’ll have their own company to run, but will Rupert, Lachlan, and James be satisfied overseeing Fox News, the Fox broadcast network, and Fox Sports in such a pared-down form? They’ll also, as part of the deal, receive a small stake in Disney. But could they somehow leverage the merger into a seat at the table for father or sons? Disney chief Bob Iger is expected to extend his contract as CEO beyond its current mid-2019 expiration point to preside over the integration of the Fox assets. But he’ll eventually need to find a successor. As the Disney board has had no traction with internal candidates, they might be inclined to look at Fox’s formidable team. James Murdoch’s name has been mentioned as making the transition to Disney, spurring succession talk, but sources on both sides of the talks caution that there is no such stipulation in the deal.

2) Will Fox continue to make movies?

On Monday, Fox grabbed a leading 27 Golden Globe nominations, double the number racked up by any other major media company, for fielding the likes of “The Shape of Water,” “Three Billboards Outside of Ebbing, Missouri,” and “The Post.” These are gutsy, auteur-driven movies that are geared at adults. They’re also exactly the kind of movies that Disney no longer makes. The studio instead focuses on animated fantasies, Star Wars sequels, and Avengers spin-offs; big-budget offerings that appeal to all ages. Moreover, Disney got out of the indie movie game when it sold Miramax in 2010. Does it have any interest in Fox’s art house label Searchlight?

With Disney looking to launch a streaming service, there’s an argument to be made that it needs as much content as possible to attract customers. If Disney wants to create a Netflix killer, that won’t just require having access to Captain America and Luke Skywalker. It may mean offering up a few R-rated movies. Fox knows how to do that.

3) Will the Justice Department OK the deal?

Rupert Murdoch has friends in high places (namely a certain Oval Office occupant), but it’s tough out there for media mergers. Just ask the folks at AT&T and Time Warner. That pact is currently being held up by the Justice Department over anti-trust concerns. That deal is a vertical one, meaning that the two companies operate at different stages of a product’s supply chain and have very few overlapping operations. The Disney and Fox deal is a horizontal merger, in other words that they are in the same business. Historically, horizontal mergers have faced more hurdles in getting government approval because they have a greater chance of creating monopolies. It remains to be seen how this corporate marriage will be greeted in Washington and if Disney and Fox will have to jettison any television or film holdings in order to appease the government.

4) Will Iger stay longer?

Iger’s tenure at Disney has been a dramatic one. He’s shown a willingness to make bold bets, snapping up Pixar, Marvel, LucasFilm, and, now, Fox. Managing all these fiefdoms takes talent. Iger is currently slated to step down in 2019 when his contract expires. But there’s no successor in place, and the pressure will be on him to sign up for another tour of duty. That may mean putting his (not so secret) presidential ambitions on the back burner.

5) Will the X-Men team With the Avengers?

Fanboys and fangirls don’t seem to care about monopolistic niceties or the end of the era for the Murdoch gang. They’re more interested in seeing Wolverine hanging out at Avengers HQ. Those dreams could soon come true. After all, the Fox purchase does give Disney, and in particular Marvel, its comic book division, rights to several superheroes that it had licensed to Fox. Not only does the company now have the ability to make X-Men movies, but it can also reboot the Fantastic Four. There’s a whole new world of mutants and costumed heroes just waiting to join the MCU. That leaves only Sony’s Spider-Man films existing outside of Disney and Marvel’s direct control.

6) What does this mean for Netflix?

Buckle up. Netflix has fashioned itself into the de facto subscription streaming service, luring tens of millions of customers to its platform. But Disney wants in on the business. The company has already announced plans to build a standalone streaming service by 2019, and with the Fox deal, it will not only be able to offer films and shows from Pixar, Marvel, and LucasFilm. It can add programming from the likes of FX and National Geographic, along with movies such as “Alien” and “Avatar” from the Fox studio catalogue. Plus, by purchasing Fox’s assets, Disney will have majority control of Hulu, giving them even more access to those digital dollars.

7) What happens to the Fox lot?

Fox’s Century City sound stages are the stuff of Hollywood history. Will Disney get the 50-plus acres of production and post-production facilities that sit on incredibly valuable Westside real estate? It may not want them. Given that the company already has its own substantial studio lot in Burbank, does it want to maintain offices on both sides of the 134 freeway?

8 ) What becomes of the Fox Broadcast network?

The upstart network that broke up the hegemony of the Big Three networks in the late 1980s may be in for a dramatic makeover. The word is the Murdochs intend to refocus Fox Broadcasting around news and sports. Fox has been struggling to gain traction with scripted programming in recent years. With the network’s sibling studio on its way to Disney, it’s hard to see how Fox can invest big bucks on high-end dramas and comedies. It would be just like the Murdochs to zig while the rest of the industry is zagging in the Peak TV era.

9) How will producers and creative talent under contract at Fox react to the Disney takeover?

Ryan Murphy could soon be working for Disney. Fox’s TV and film divisions have a long list of production pacts with top filmmakers, writers, producers, and directors. Disney has a approach to content, which may not be a fit for everyone. In the short-term, however, 20th Century Fox and its units will operate autonomously, at least until the deal is completed.

10) How much synergy savings will Disney promise Wall Street?

Analysts have zeroed in on about $2.5 billion in potential streamlining and elimination of redundancies within a few years after the deal is completed. That sounds like a big human toll, but for an operation the size of Disney, particularly after it has swallowed up the Fox assets, there may be less painful ways to squeeze out economies of scale.

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

It'll be interesting to see how it affects The Gifted. 1 MORE DAY!!!!!!!!!!!

UltimateMarvel- Posts : 10277

Join date : 2014-12-09

Location : East Coast

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

UltimateMarvel wrote:It'll be interesting to see how it affects The Gifted. 1 MORE DAY!!!!!!!!!!!

The Murdoch's are gonna clean house and gut Fox.

I expect them to cancel Gotham, Brooklyn 99, Last Man on Earth and yes possibly even The Gifted. All are fairly lowly rated and those Murdochs will just load Fox up with reality shows about athletes and no name celebrities doing anything for attention and money.

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

WyldeMan wrote:UltimateMarvel wrote:It'll be interesting to see how it affects The Gifted. 1 MORE DAY!!!!!!!!!!!

The Murdoch's are gonna clean house and gut Fox.

I expect them to cancel Gotham, Brooklyn 99, Last Man on Earth and yes possibly even The Gifted. All are fairly lowly rated and those Murdochs will just load Fox up with reality shows about athletes and no name celebrities doing anything for attention and money.

WTF?!!! I hope not. Unacceptable.

UltimateMarvel- Posts : 10277

Join date : 2014-12-09

Location : East Coast

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

UltimateMarvel wrote:WyldeMan wrote:UltimateMarvel wrote:It'll be interesting to see how it affects The Gifted. 1 MORE DAY!!!!!!!!!!!

The Murdoch's are gonna clean house and gut Fox.

I expect them to cancel Gotham, Brooklyn 99, Last Man on Earth and yes possibly even The Gifted. All are fairly lowly rated and those Murdochs will just load Fox up with reality shows about athletes and no name celebrities doing anything for attention and money.

WTF?!!! I hope not. Unacceptable.

You just wait....

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

That's the least evil thing the Murdochs will be doing

Tyger- Posts : 3482

Join date : 2014-12-09

Location : Utah

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Tyger wrote:That's the least evil thing the Murdochs will be doing

No doubt. The Murdochs and the Kochs, true evil runs in the family.

Early rumors are now that with a controlling interest in Hulu, it might be be folded into Disney's upcoming streaming service so they can overtake Netflix once they lose access to all Fox and Disney titles....

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Every Movie Franchise Disney Just Got from Fox

It's now a done deal. After weeks of rumors and discussion, Disney has officially purchased the majority of 21st Century Fox, including the entirety of their movie studio 20th Century Fox, among many other valuable assets. The deal is valued at $66 billion and is quite possibly the biggest shake-up in Hollywood history. Disney has become an absolute franchise machine in recent years and, with this Fox deal, they're going to be untouchable as they've just purchased a ton of new franchises to mine for box office gold.

Starting with the big ones on everyone's mind, Fox is now in control of virtually every Marvel property under the sun, assuming the deal is allowed to go through. The deal still needs to be approved, legally speaking, and that could take a while. Assuming that all works out, Disney will officially be in control of the X-Men, Deadpool and (possibly) the Fantastic Four film rights. As far as Fantastic Four goes, a company called Constantine Films actually owns the rights, but Fox has been distributing and producing the movies. So that's a bit complicated. But Disney definitely now owns everything under the X-Men banner, which is truly massive.

Disney also now owns quite a few major, historically R-rated franchises. Without getting too much into what the future of these franchises may be under the roof of the Mouse House, a studio that doesn't really make R-rated movies, there are a ton of key properties they now have. For one, they now control the Alien and Predator franchises. There's also Die Hard, which has been dormant for a while, but its chances of being resurrected are now slimmer, it would seem. There's also Red Sparrow, which comes out next year and stars Jennifer Lawrence. That has franchise potential written all over it. And Kingsman appears to be a substantial property with Kingsman 3 moving forward.

Under the new Fox deal, Disney also managed to scoop up a lot of big-name sci-fi. They now control the Planet of the Apes franchise, which has been doing very well recently, with War for the Planet of the Apes being released just this year. They also own The Martian, which has a sequel of sorts in the works, Artemis, based on a book by the same author. And let's not forget Avatar, which is one of the biggest elements of this deal overall, considering James Cameron is now in production on two sequels and has plans for two more. Disney is going to get all of that sweet Avatar 2 and Avatar 3 money. At least. And let's not forget Independence Day. Though, Independence Day: Resurgence did a fine job of killing the franchise last year.

As far as Disney goes, some of the meatiest parts of this Fox purchase come in the form of family-friendly franchises. Fox owns Alvin and the Chipmunks, Doctor Dolittle, Home Alone, Ice Age, Night at the Museum, The Chronicles of Narnia and Percy Jackson. Assuming the deal is approved, that means Disney has a crazy amount of family franchises they can possibly pursue. There's also The Maze Runner, which wraps up next year with Maze Runner: The Death Cure, which falls into the young adult category.

Last, but most certainly not least, Disney now owns every shred of Star Wars. Yes, they purchased all of Lucasfilm in 2012, but Fox still owns the home video rights for the original Star Wars, since they produced the first movie with George Lucas. There have been complications because of this, but those complications will no longer exist the moment this deal is approved. Does this mean we'll finally get the original, unaltered cuts of the original trilogy on Blu-ray? One can only hope. Disney likes money and they're going to have to make a lot to justify this purchase and that's one way to bring in a lot of it. Either way, Disney has more franchises than any single studio has ever had or likely ever will. Here is the full list of what Disney is getting in terms of franchise.

Avatar

Star Wars

Die Hard

X-Men

Fantastic Four

Kingsman

Planet of the Apes

Alien

Predator

Independence Day

Fight Club

Home Alone

Night at the Museum

The Maze Runner

Ice Age

Red Sparrow

The Martian

Artemis

Alvin and the Chipmunks

Doctor Dolittle

Percy Jackson

The Chronicles of Narnia

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

For now, I think this is an awesome deal. Until we see some down sides, this is wonderful news. I only hope they don't mess with their rated R titles like Deadpool, just keep it going and bring in some new stuff. Disney doesn't always have to be PG-13. Maybe Deadpool can teach them this lesson.

UltimateMarvel- Posts : 10277

Join date : 2014-12-09

Location : East Coast

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

The Murdochs Would Become Disney’s Largest Individual Shareholders When Merger Clears

Trust a savvy deal-maker like Rupert Murdoch to wring the most from any negotiation.

The 86-year-old media mogul and his family would emerge as the single largest individual shareholders in Disney once the proposed $66 billion deal for 21st Century Fox’s film and television assets closes. Only the mutual fund Vanguard would have more significant holdings in the Burbank media giant.

The Murdochs stand to receive nearly 88 million Disney shares in the all-stock deal, based on the number of Fox shares he and his family trust reported in regulatory filings.

That’s more than the 64 million shares owned or directly controlled by Laurene Powell Jobs, the widow of Steve Jobs. The late Apple co-founder became Disney’s largest individual shareholder in 2006 with the $7.4 billion sale of Pixar Animation Studios.

Media analyst Doug Creutz of Cowen & Co. speculates that the Murdochs may be positioning themselves to run Disney one day, after CEO Bob Iger retires. That’s consistent with what we’re hearing from sources, who say James Murdoch is angling for a senior management role in Burbank.

Iger, however, was circumspect today about the younger Murdoch’s role in the company, post-acquisition.

“James and I will be talking over the next number of months. He’s going to be integral to the integration process, and he and I will be discussing whether there is a role for him or not at our company,” Iger said.

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

The Murdochs want to run Disney? LOL. The fucking greedy appetites on those fat old bastards......

_________________

Wylde's Favorite Films of 2024:

Dune Part II

Wylde's Favorite Series of 2024:

Fallout (Prime), The Gentleman (Netflix), Shogun (Hulu/Disney+)

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Disney-Fox Deal Is the Rotten Cherry On Top of a Miserable 2017 For Everyone But Theater Owners and the X-Men

Just when you thought 2017 couldn’t get any worse, along comes Disney’s super-deal to acquire 20th Century Fox (as well as the TV studio, FX, National Geographic and a bunch of other Murdoch-owned properties including Fox’s 30 percent stake in Hulu) and spoil Hollywood’s holiday cheer as fear spreads throughout the Pico lot. The truth is that it could be two years before this mega-merger is approved by the DOJ, so while it may not be business as usual at Fox, any disruption should be minimal.

Of course, given the overlap in Fox and Disney’s marketing, distribution and production departments, there are bound to be layoffs, which is sad all around. I know, because I’ve been there, with Variety back in 2009. It may be early for people to start preparing their resumes, but honestly, this kind of thing could happen to any studio these days as the industry contracts. It’s probably worse for the town (one less buyer, gulp!) than the consumer, which right now, seems more focused on the tantalizing possibility of the X-Men and the Fantastic Four (two worn-out franchises that could, admittedly, be rejuvenated by this merger) joining the Avengers, but it’s likely to be bad for both.

The other problem the Disney-Fox deal could lead to is a chain reaction of mega-mergers if other conglomerates start to feel small compared to a newfound behemoth like Disney. How will Comcast react? Does it stand pat with Universal, which besides Disney, feels like the steadiest of the other studios, or does it go on a shopping spree after flirting with acquiring 20th Century Fox itself? Could Viacom decide to sell Paramount? Would Sony sell off its movie studio? Will giant companies acquire independent studios like Lionsgate (a strong fit for CBS), MGM and A24? I suppose it all depends on whether AT&T will be allowed to acquire Warner Bros. for a cool $85 billion despite the Justice Department’s lawsuit to block the “vertical” deal.

Speaking of which, as noted above, the “horizontal” Disney-Fox deal is expected to take 12 to 18 months to close according to Disney CFO Christine McCarthy. Each studio’s board of directors has approved the transaction, but it’s still subject to shareholder (stocks have risen) and DOJ approval. Of course, Rupert Murdoch is said to be friendly with Donald Trump, and White House spokeswoman Sarah Huckabee Sanders confirmed that the President congratulated Murdoch, adding that it “could be a great thing for jobs.”

That remains to be seen, though it’s entirely possible that Murdoch could decide to beef up his remaining assets such as the Fox Broadcasting network and stations and the Fox News Channel, which will be spun off into a separate company immediately prior to the Disney acquisition. After all, Fox will still have to compete with rising media companies like Netflix, Amazon and Hulu, which Disney may decide to expand beyond the U.S. and into international markets. Now that it is no longer tied to 20th TV, Murdoch expects the Fox network to be popular among sellers, as studios like Warner Bros. TV and Sony Pictures TV “will be looking to us to buy programs.”

Hulu, for its part, will likely complement the SVOD service that Disney plans to introduce in 2019, which will include first-run movies once its Netflix deal expires. But as Variety notes, the question remains whether majority owner Disney will try to buy the remaining 40 percent stake in the company from Comcast/NBCUniversal and Time Warner, and whether those companies are even willing to sell. Hulu’s 16 millions SVOD subscribers ain’t nothing, and the company took years to build that audience. Hulu may not be Netflix, now or ever, but it has elbowed a place for itself at the streaming table.

And here’s the other elephant in the room: Is Disney even done buying right now? After all, the company isn’t just battling current threats like Netflix and Amazon, but future ones like Apple, which is just starting to produce its own content and will likely take a few years to find its footing.

20th Century Fox leadership has scheduled four Town Hall-style meetings — three today and one Friday — to address the deal and what it means for the studio’s employees. Fox’s chairman/CEO Stacey Snider reportedly canceled her trip to Washington DC for The Post premiere so she could personally meet with staffers, who will either be absorbed by Disney or bought out in the long run.

As for the 53 acres of ground beneath their feet, Disney has inked a deal to lease the Fox lot in Century City for seven years, according to Variety. That’s valuable real estate (approximately $425 million) that Murdoch wasn’t so eager to part with, but you can’t just immediately displace the thousands of people who work there.

So what else does it mean to go from a six-major to a five-major town for the first time in more than 50 years? It means that fewer studios movies will hit theaters, which is bad for creatives in this town, but may not necessarily be so bad for business, since right now, movies cannibalize each other at the box office. You have one weekend to do big business before another comic book movie arrives to rain on your parade. With release calendars as crowded as ever, more space between larger titles could be a good thing, as it gives small films a chance to breathe and find their audience.

As for 20th Century Fox, speculation has Disney treating the studio like an adult-oriented label run by Stacey Snider. Think Die Hard, Predator, Alien, Kingsman and prestige dramas like Steven Spielberg’s The Post. Stuff that’s a little too edgy for the family-friendly Disney brand, but isn’t quite Miramax-Level of risqué. Fox Searchlight is also expected to continue operating as a specialty label focusing on arthouse fare. If there’s any division that could find itself in jeopardy its Fox 2000, but that’s pure speculation on my part. They make fine films, I just don’t know why Disney would need so many labels, that’s all. It’s also worth questioning the fate of Blue Sky Studios, since Disney already has its own animation studio in addition to a little company called Pixar. It’s unclear whether that label will remain intact, or whether its animators will be absorbed inside either Disney Animation or Pixar.

As far as exhibition is concerned, the Disney-Fox deal is a mixed blessing. Between Star Wars and the Marvel movies, Disney is the studio most eager to protect the 90-day window between a film’s theatrical release and its home entertainment release, so on that front, theater chains should be happy. However, smaller, independent theaters may find it difficult to push back on Disney’s terms now that it will enjoy 40 percent market share, with Fox films possibly calling for the same cushy deal that Disney movies currently receive. It’s not quite a monopoly, but it’s pretty close. Just look at the month of December for the next several years. It’s going to be tough for studios to compete with Disney’s Star Wars and Fox’s Avatar franchises, which are expected to dominate the field. And let’s not forget potential Pixar movies around Thanksgiving. This year, Coco topped the box office for several weeks before it being (inevitably) dethroned by its corporate sibling The Last Jedi.

Meanwhile, last spring I had the chance to ask Kevin Feige a few questions prior to a screening of Guardians of the Galaxy Vol. 2, so I asked him if Marvel planned to make any R-rated movies, and he said something to the effect of, “not at this time.” It’ll be interesting to see if Feige changes his tune following Thursday’s announcement from Disney chairman/CEO Bob Iger that “there might be an opportunity for a Marvel-R brand for something like Deadpool,” which Disney now owns. Crazy, right? As long as we let the audience know what’s coming, we think we can manage that fine,” said Iger, who also extended his contract through 2021. So much for that presidential run in 2020!

Deadpool star Ryan Reynolds seemed pleased with his character’s new corporate overlords on Twitter, but the Writers Guild of America West weren’t as happy, releasing the following statement:

“In the relentless drive to eliminate competition, big business has an insatiable appetite for consolidation. Disney and Fox have spent decades profiting from the oligopolistic control that the six major media conglomerates have exercised over the entertainment industry, often at the expense of the creators who power their television and film operations. Now, this proposed merger of direct competitors will make matters even worse by substantially increasing the market power of a combined Disney-Fox corporation. The antitrust concerns raised by this deal are obvious and significant. The Writers Guild of America West strongly opposes this merger and will work to ensure our nation’s antitrust laws are enforced.”

Time will tell how successful the guild is, but I’m betting there won’t be much anyone can do to disrupt this merger. Sometimes in life, and especially in Hollywood, you just have to surrender. Studios should get their white flags ready, because there will be few places left to hide on the release calendar.

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Disney-Fox Deal: 5,000 To 10,000 Jobs Will Likely Be Shed: Analyst

On the day after Disney’s game-changing takeover of most of 21st Century Fox for $66B, including debt, the merger’s likely toll on the combined workforce is starting to become more clear.

Rich Greenfield, an analyst with BTIG who has long been a bee in Disney’s bonnet, believes at least 5,000 or as many as 10,000 jobs could be at stake.

The analyst, who has damaged Disney stock before by highlighting subscriber losses at ESPN, among other issues, issued a new report today titled, “Disney’s $2 Billion in Synergies is Good for Jobs #FakeNews.” The headline and hashtag refer to a comment yesterday from White House press secretary Sarah Huckabee Sanders. President Donald Trump, a longtime ally of Rupert Murdoch, called the Fox mogul to congratulate him, enthusing that the deal “could be a great thing for jobs,” Sanders told incredulous reporters at a briefing.

“Disney expects over $2 billion in synergies from the Fox acquisition, with the overwhelming majority of that from cost-savings–meaning job cuts,” Greenfield wrote. While the expected reduction of film releases is itself a form of job shrinkage, more significant layoffs are on the horizon. “In order to reduce costs by upwards of $2 billion, we believe Disney will need to cut well-over 5,000 jobs and the number could easily swell toward 10,000 given the high degree of overlap between the two companies around the world.”

A report from MoffettNathanson estimates the cost synergies could be closer to $2.5 billion.

While the Writers Guild of America and other groups have blasted the deal on everything from anti-trust to anti-family grounds, Greenfield has put a finer point on the job numbers. According to its most recent annual report, Disney’s global workforce is 195,000. Fox’s is 22,000, per its latest annual report.

In a memo to employees yesterday, Rupert Murdoch all but acknowledged that layoffs were coming. “We are deeply committed to finding opportunities for our people as well as ensuring that anyone impacted is well taken care of,” Murdoch he wrote.

Disney chief Bob Iger highlighted “efficiencies” from the deal yesterday, but indicated they would be achieved over a longer timeframe. Regulatory approval is not expected until 2019 and the full integration will take effect in 2021.

Greenfield isn’t the only bear on Disney. Brian Wieser of Pivotal Research published a report today reaffirming his sell rating on Disney, explaining that its portfolio has liabilities in a tech-driven world, regardless of how streamlined the workforce becomes. He forecasts “ongoing margin compression for the company’s media networks businesses, both because of rising costs for sports rights and programming more generally.” He added, “Direct to consumer media offerings are likely to be lower margin than legacy business models.”

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Disney-Fox Deal Unleashes Flood of Free-Agent Executives, Talent

Disney’s $52.4 billion deal to scoop up most of 21st Century Fox marks the beginning of an historic realignment of Hollywood’s Big Six studios. It may also lead to an industry-shaking redistribution of executive and creative talent.

Rarely has such a large number of high-level executives suddenly become free agents, from Stacey Snider and Emma Watts on the 20th Century Fox film side to TV heavyweights John Landgraf, Dana Walden, and Gary Newman — not to mention 21st Century Fox president Peter Rice, who oversees all TV.

Beyond the boldface names, there are ranks of seasoned executives at Fox and Disney/ABC who are nervous about their future, after hearing Disney’s promise of delivering $2 billion in cost savings within two years of the deal’s closing. But this flood is also hitting at a time when Netflix, Amazon, Apple, Facebook and other upstarts are beefing up their operations as they launch the push into the content business that drove Disney’s interest bolstering its engines by buying out Fox. The dispatch of a slew of Fox-trained executives could wind up adding fuel to the Great Disruption from digital startups with checkbooks that dwarf traditional TV outlets.

Nonetheless, the agita about job security in Burbank and Century City has been heightened by the lack of specifics about management plans in Disney’s Dec. 14 announcement of the agreement to acquire 20th Century Fox’s film and TV operations, the FX Networks cable group, National Geographic, and 22 regional sports channels, among other assets. Fox’s 30% stake in Hulu is also crucial in the deal as it will give Disney majority control of the streaming service just in time for the company’s dive into the stand-alone streaming content biz.

Iger has sketched out a broad vision of Disney focusing on three distinct content apps, an ESPN-branded sports service, a Disney-branded offering of family-friendly fare from its Marvel, Pixar, and LucasFilm brands, and Hulu as the home for adult-oriented fare from FX, ABC, 20th Century Fox film, and Fox Searchlight.

“We certainly are intent on creating a larger, more unified television production studio for the company,” Iger told Wall Street analysts on Thursday.

“The plan is to take the best of both companies and put them together, people and product. … It’s not going to be an ‘all of us’ and ‘none of them,’ they’ve got a very strong talent pool and a lot of great IP and the ability to create a lot of IP,” Iger said. “So our approach is going to be essentially to field the best team with the best product out there.”

But in terms of specifics, Iger has only said that even 21st Century Fox CEO James Murdoch has to wait for discussions on his future to be held down the line. Disney and Fox are bracing for a regulatory review of the deal that could last as long as 18 months. A year-plus is a long time for executives to be in limbo, which means the job hunt for many began last Thursday. And that dynamic will likely force Iger to make some timely calls on executives at both shops with employment contracts that expire in the coming months.

Walden, chairman-CEO of Fox Television Group, and 20th Century Fox chairman-CEO Snider are both known to have had discussions with Amazon about filling the top job at Amazon Studios left vacant after the departure of Roy Price in October, following sexual harassment allegations. Those conversations were underway before rumors of the Disney-Fox deal surfaced in early November. They may take on more urgency now.

Industry speculation has Landgraf’s fiefdom potentially enlarging to include programming for Hulu as well as FX Networks. Rice, Walden, and Newman are likely contenders for top studio management jobs at Disney, given their respective track records and experience. How the integration process might affect Disney/ABC TV Group chief Ben Sherwood and business operations president Bruce Rosenblum remains to be seen. Insiders on both sides reported bracing for a “free-for-all” of lobbying and jockeying in the coming weeks.

Iger has been effusive about the strength of Fox’s creative output and management bench in talking up the deal.

“When you think about the management that’s supervised the creation of an unbelievable array of great shows — including ‘This is Us’ and ‘Modern Family’ to name a few — and using that creative oversight and the relationships they have with creators to create directly for our service or our networks, we think that’s very powerful,” Iger told analysts.

The fate of Walden will surely have a big impact on Fox’s long-term relationship with its most prolific producer, Ryan Murphy. The uber-showrunner behind so many FX and Fox series franchises is in the midst of contract renewal negotiations on a massive overall deal with 20th Century Fox TV deal that expires at the end of July. Murphy is personally close with Walden, as well as FX’s John Landgraf. Where those executives end up will play a big role in where the steward of “American Horror Story,” “American Crime Story,” “Feud” and other shows takes his future business.

With so many players and positions to sort through, Iger’s holiday season to-do list just got a whole lot longer. Given his focus feeding “high-quality content” through Disney-owned pipelines around the world, Iger’s first call might well go to Murphy.

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Wow! People losing their jobs, I guess this part of the down side to this deal.

UltimateMarvel- Posts : 10277

Join date : 2014-12-09

Location : East Coast

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Comcast today submitted a competing bid for 21st Century Fox, initiating what could well result in a high-stakes bidding war with its biggest media rival, The Walt Disney Co.

The U.S. cable giant made an all-cash offer of $65 billion to acquire much of Fox’s film and television assets, its international holdings and its stake in the Hulu streaming service. The $35-per-share offer represents a 19% premium on Disney’s $52.4 billion all-stock offer for the same assets.

“We have long admired what the Murdoch family has built at 21st Century Fox,” wrote Comcast CEO Brian Roberts in a letter addressed to Rupert, Lachlan and James Murdoch (read it in full below). “And our meetings last year, we came away convinced that the 21CF businesses to be sold are highly complimentary to ours, and that our company would be the right strategic home for them.”

Roberts expressed disappointment in Fox’s selection last year of Disney as its deal partner, despite Comcast’s more lucrative all-cash offer. The company decided to sweeten the deal following yesterday’s ruling in the AT&T-Time Warner antitrust case.

Comcast confirmed last month it planned to make a rich counter-offer for Fox, but appeared to be awaiting the outcome of the AT&T-Time Warner merger that was being challenged in court by the U.S. Department of Justice. Judge Richard Leon yesterday eviscerated the DOJ’s arguments in seeking to block the deal on an untested theory of competitive harm by the combining of two companies whose businesses do not overlap.

“The clarity of his opinion and his urging of the DOJ not to appeal this decision (as a means of disrupting the transaction, which must close by June 21) will likely be interpreted by Comcast as a green light to bid for Fox’s assets,” notes media analyst Michael Nathanson.

The decision clarified an uncertain regulatory environment and emboldened the cable operator to make its move on Fox. Nathanson predicted a $40-per-share bid for Fox’s assets, well in excess of its earlier $34.41 offer. He and other Wall Street analysts expect Disney to match Comcast’s offer, potentially taking on $37 billion in debt to do so.

“We continue to believe that Disney has the superior balance sheet, cost of debt, equity and rationale to emerge victorious over Comcast in a bidding war,” Nathanson writes. “The question is will Disney’s board and management go to the mat on this transaction? We think the answer is yes.”

In its offer letter today Comcast matched Disney’s commitments to Fox, including the same $2.5 billion termination fee if the deal fails to close, and also reimburse Fox for the $1.5 billion break-up fee it would pay Disney in conjunction with walking away from the deal.

Comcast also promised the same divestiture package as Disney, agreeing to sell off thee regional sports networks or any part of the business representing pre-tax earnings of up to $500 million.

Significantly, it would also cover any tax obligations from the transaction.

For Comcast, which is largely a domestic company, Fox represents a major leap onto the global stage. Fox’s 39% stake in the UK’s Sky and in Star India would boost the U.S. cable operator’s international income to 25% of revenue. The math was obviously a key driver of Comcast’s pending $31 billion bid for Sky; both acquisitions will now be pursued concurrently.

New sources of revenue would bolster Comcast’s bottom line as it copes with a structural decline in pay TV business in the U.S. as price-sensitive consumers cancel their subscriptions or opt for lower-cost video services.

Fox’s entertainment assets — its film and television studios, the Fox film franchises and deep library, the FX and National Geographic cable TV networks, and 22 cash-cow regional sports networks — would enhance Comcast’s entertainment portfolio. The company already owns NBCUniversal and DreamWorks Animation and America’s largest cable TV system.

Such an entertainment arsenal would be valuable in building a direct-to-consumer service, as Disney cited as part of rationale for its own offer for Fox.

Through a Fox deal, Comcast would gain a controlling interest in the fast-growing Hulu streaming service, in which it now shares a one-third stake with Fox and Disney; Time Warner holds a 10% stake in the over-the-top service.

Hulu helps make Fox “a kingmaker asset,” in the view of UBS analyst John Hodulik. In a research note, he wrote that acquiring Fox would help Comcast gain of Hulu, with its 20M subscribers and the potential to challenge dominant Netflix.

Comcast will need to convince Fox’s board of directors — and ultimately, its shareholders — that the deal would not pose greater regulatory risks than Disney’s offer. That’s no trivial consideration, since the U.S. government imposed conditions on Comcast’s 2011 purchase of NBCUniversal to protect competition.

Roberts addressed this head-on in his letter to the Murdochs.

“We are … highly confident that our proposed transaction will obtain all necessary regulatory approvals in a timely manner and that our transaction is as or more likely to receive regulatory approval than the Disney transaction,” Roberts wrote.

He also urged swift action, noting that Disney and Fox’s shareholders are scheduled to vote July 10 on that deal.

“We are available to meet at any time to answer questions of the board, management or your advisors, so that you are in a position to validate the superiority of our offer, and negotiate and enter into a merger agreement, as soon as possible thereafter, Roberts wrote.

The competitive stakes for the cable giant, which abandoned its 2004 bid to acquire Disney, are just that high.

“We increasingly believe Comcast views the acquisition of both Fox and Sky as ‘must-wins’ as it tries to replicate Disney’s size and global scale/prowess in content creation (Comcast has long had “Mouse Envy”),” wrote BTIG analyst Rich Greenfield. “Not only are there no obvious alternatives to Fox/Sky, if Disney succeeds in the purchase of both companies, Comcast is unlikely to ever be able to catch-up or even draw close to Disney’s dramatically enlarged global footprint.”

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Damn! Let Disney have it so we can have all Marvel characters in one place.

UltimateMarvel- Posts : 10277

Join date : 2014-12-09

Location : East Coast

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

Re: Comcast Launches $65 Billion Bid For Fox, Topping Disney’s Offer

AT&T Completes $85B Acquisition Of Time Warner

AT&T has finalized its $85 billion deal to acquire Time Warner, two days after a federal judge cleared the way and ruled in favor of the merger over objections from the U.S. Department of Justice.

“The content and creative talent at Warner Bros., HBO and Turner are first-rate. Combine all that with AT&T’s strengths in direct-to-consumer distribution, and we offer customers a differentiated, high-quality, mobile-first entertainment experience,” said Randall Stephenson, chairman and CEO of AT&T Inc. “We’re going to bring a fresh approach to how the media and entertainment industry works for consumers, content creators, distributors and advertisers.”

Jeff Bewkes, the chairman and CEO of Time Warner which includes Warner Bros, Turner and HBO, has agreed to remain with the company as a senior advisor during a transition period, AT&T said. The units will now be part of AT&T’s Media business under entertainment boss John Stankey.

“Jeff is an outstanding leader and one of the most accomplished CEOs around. He and his team have built a global leader in media and entertainment. And I greatly appreciate his continued counsel,” Stephenson said.

The Media business will get a new name.

Similar topics

Similar topics» Major Studios Plan to Offer $30 Rentals for Early in Home Viewing

» Top Gun: Maverick ($1.5 Billion Worldwide Box Office)

» Aladdin ($1 Billion Worldwide Box Office)

» Toy Story 4 ($1 Billion Worldwide Box Office)

» The Joker ($1 Billion Worldwide Box Office)

» Top Gun: Maverick ($1.5 Billion Worldwide Box Office)

» Aladdin ($1 Billion Worldwide Box Office)

» Toy Story 4 ($1 Billion Worldwide Box Office)

» The Joker ($1 Billion Worldwide Box Office)

Permissions in this forum:

You cannot reply to topics in this forum|

|

|